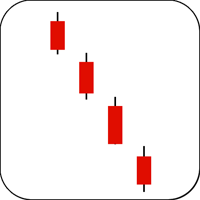

Three Gaps Down Candlestick Formation

Description

The ideal Three Gaps Down candlestick formation is composed of 4 candlesticks. The first 2 candles can be either red or green, as long as the body of the second candle gaps below the body of the first. The third and fourth candles should be be red, and both bodies should gap below the previous body. This is a reversal pattern which warns of an overextended move.

A more general version of Three Gaps Down candlestick formation is to watch a bear market move and keep an eye out for 3 gaps down during the move which do not get filled. Once the third gap is in place, start looking for the bull market to run out of steam and reverse.